Updated June 2022

What is the Medical Loss Ratio or “MLR”?

Federal law (the Affordable Care Act) and state law require that health insurance companies spend a minimum percentage of their policyholders’ premiums on medical expenses. Medical expenses are defined as not only the clinical care and services provided to plan members, but activities designed to improve health care quality as well.

This minimum percentage, or threshold, that health insurers must meet is called the Medical Loss Ratio (“MLR”). The MLR standard applies to health insurance plans offering group or individual coverage. It does not apply to self-insured plans.

When setting premium rates for each upcoming year, insurers must make calculated estimates based on the most current cost trends. Due to a number of factors, what’s projected often differs from what’s actually spent (as with setting household budgets).

If a health insurer spent less on medical expenses than what was projected (the amount upon which premiums for the year ahead are based), the MLR requirement ensures that affected consumers receive money back on the unused portion of their premium.

What was the required MLR for 2020?

This grid shows the 2020 MLR thresholds by market and state.

To whom did Harvard Pilgrim issue 2020 rebates?

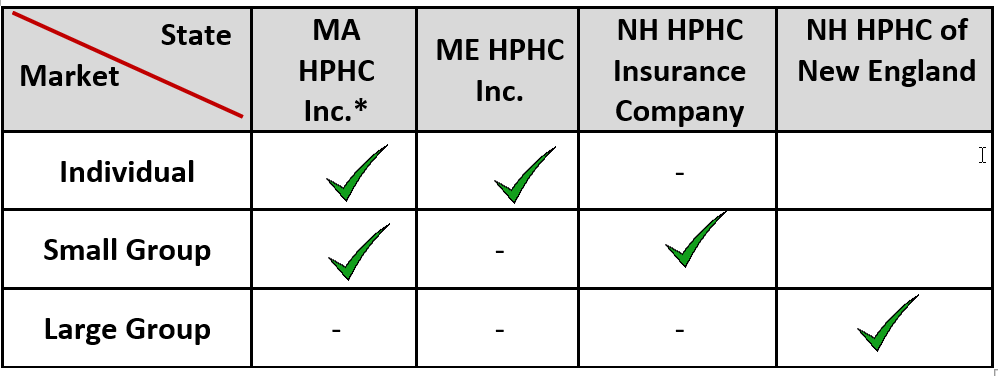

Harvard Pilgrim offers plans under different licenses in different markets and states, and has issued 2020 MLR rebates in limited markets. This grid shows where and how MLR rebates apply for Harvard Pilgrim:

* In Massachusetts, individuals and small groups are treated as merged market

Note: The MLR rebate applies only to the premiums under the Harvard Pilgrim Health Care license and does not apply to premiums under the HPHC Insurance Company license.

When were notices sent?

Notices will be sent to all individuals and groups who will receive a rebate. Notices will also be sent to subscribers belonging to those groups receiving a rebate. State and/or federal MLR rebates and notification letters sent to employer groups and individuals, postmarked on or before August 31, 2021, for HPHC, Inc. Massachusetts merged market and September 30, 2021, for Maine HPHC, Inc. individual and New Hampshire HPHC Insurance Company small group.

How and when will the rebates be issued?

Rebates for Maine HPHC, Inc. individual and New Hampshire HPHC Insurance Company small group customers were issued a credit reflected on the October invoice. HPHC, Inc. Massachusetts merged market individual and small groups customers were issued a check by mail no later than August 31. If a rebate recipient is no longer a customer, a rebate check was sent to the address on file.

Update as of June 2022: After an internal audit of our 2020 rebates, a recalculation was determined and we are issuing additional rebate checks, including interest, as appropriate to Massachusetts HPHC, Inc. small group customers and HPHC Insurance Company New Hampshire small group customers. In addition, we are issuing first-time 2020 rebate checks to New Hampshire HPHC of New England large group customers. Checks will be mailed by June 30, 2022.

Are my taxes affected by this rebate?

Rebates may have a tax impact both to plans receiving rebates and to consumers. Please consult with your financial and tax advisors regarding the tax impact of the rebate, or contact the IRS at (800) 829-1040.

Additional MLR Rebate FAQ’s

For Brokers

For Subscribers

Click here to view 2019 MLR Rebate Info